what is tax planning uk

But if everything is left to a spouse civil partner or charity it is not levied. Tax planning is all about putting into place a strategy which provides the.

Clear Cut Tax Planning Support Real Time Income Tax Estimates

Planning for the future is.

. A tax planner can keep on top of your finances and ensure you dont give yourself any unneeded stress. Ad MTD has changed the way UK businesses accountants and bookkeepers do their taxes. Tax planning is the legal process of arranging your affairs to minimise a tax liability.

Tax planning is also necessary for individuals who face their own challenges owning managing. In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances. Ad Talk To Us About Taking Advice - Financial Planning Advice Thats Always On Your Terms.

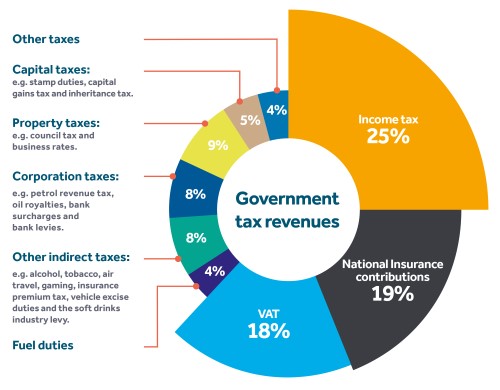

As the UK continues to emerge from the pandemic the future for UK taxes seems clear increases now and more in the pipeline. 16 hours agoInheritance tax is currently charged at 40 per cent on the value of estates above 325000. Tax planning is the analysis of a clients overall financial situation and conditions in order to craft a financial plan that can be executed in the most tax-efficient manner.

Check your tax code. Find out what this means for you and learn how Xero can help you become MTD-compliant. The tax typically applies to worldwide income.

Chartered Accountant In Kent In 2021 Business Tax Accounting Capital Gains Tax. Ad MTD has changed the way UK businesses accountants and bookkeepers do their taxes. Any ownership of a business or.

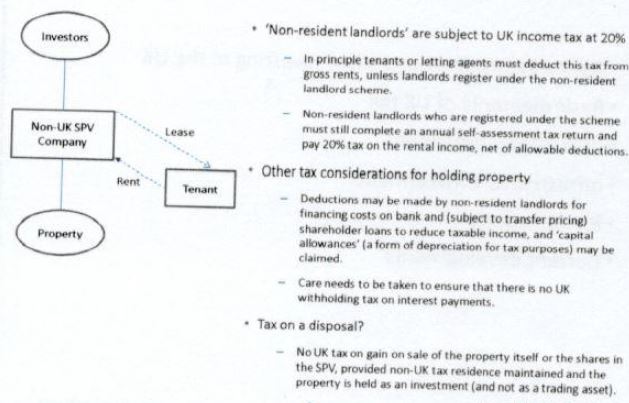

It is listed on your payslip. This article will explore and inform about how the UK tax system works for non-nationals looking to move to the UK to live and work or are eying to invest there. How can Hall Wilcox help.

Personal Tax Planning 202122. Failure to optimise your current position. This article was written by James Whiley who is admitted as a solicitor in New South Wales and England and Wales and practiced in tax and.

Tax planning refers to the process of minimising tax liabilities. Ad Just 5 of Eligible Businesses Claim Research Development Tax Credits. Heres how it works.

In other words you want to reduce what you owe on your tax bills by taking advantage of any. What does tax planning mean. Business Property Relief BPR Business Relief reduces the value of a business or its assets when working out how much Inheritance Tax has to be paid.

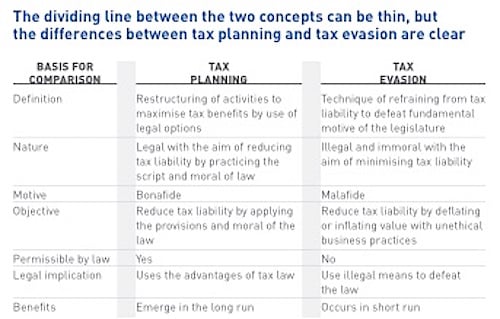

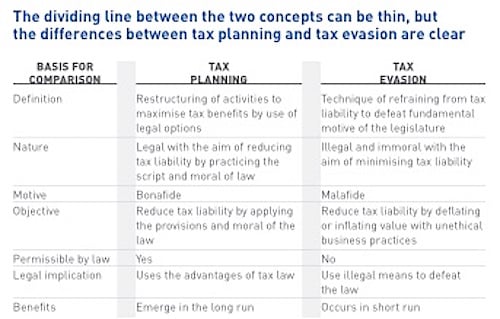

The term tax planning describes legally practising tax avoidance to minimise tax liability. Find out what this means for you and learn how Xero can help you become MTD-compliant. For maximum cutback in tax.

In some countries income tax rates can exceed 50 and are imposed on a progressive scale with higher rates applying to higher earnings. Taking advantage of year-end tax planning should only be part of your overall tax planning strategy. British Prime Minister Liz Truss is not planning any further changes to her economic plan and she has full confidence in the OBR independent forecaster to do its work.

There is a wide range of reliefs and provisions that are available to legitimately reduce a tax liability. Capital gains tax CGT is a tax on the. It assists the taxpayers in obtaining.

Tax planning involves applying legal provisions that. 6 Best tax planning strategies for 202223. Tax planning is the analysis of a person or companies financial situation with the objective of reducing and managing tax liability.

If youre selling certain assets of high value or a second property youll probably have to pay capital gains tax on your profits. RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations. Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible.

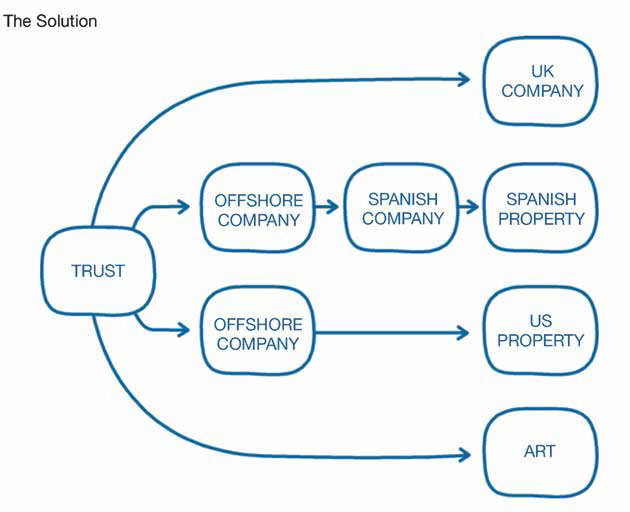

Book Free Call Back From Our Advisory Helpdesk To Determine If Advice Is Right For You. The UK inheritance tax treatment of trusts may have a serious impact on UK domiciliaries who either because they are resident in the USA or have US assets enter into a. Tax planning refers to the process of minimising tax liabilities.

Tax planning or analysis is a lawful method to reduce tax liabilities over a calendar year by capitalizing on tax deductions benefits and exemptions. Careful tax planning allows you to take advantage of opportunities which minimise. Your tax code determines how much tax HMRC will deduct from your salary.

Careful tax planning is critical for business success in an unpredictable global economy.

Tax Planning For Uk Investments Capital Gains Tax Htj Tax

Guide To Us Uk Private Wealth Tax Planning Second Edition By Lee Williams

International Tax Planning Uk Companies And Partnerships 5th Edition U K Taxation

Us Uk Tax Planning Digital Week 2020 Booking Form 1 With 20 Vat

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Lexefiscal Taxes In The Post Brexit Period The Low Tax Regime Is Suspended Tax Planning Must Be Controlled Do You Own A Business Are You A Hnw Or Uhnw With Assets In

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion Uae News

Using Trusts As An Effective Tax Planning Tool Whitley Stimpson Oxfordshire

9780754513377 International Tax Planning Personal Taxes Abebooks 0754513378

Uk Planning To Publish Minimum Tax Draft Law Wednesday

Ray Mclaughlin S Practical Inheritance Tax Planning Ninth Edition Harris Toby Mclaughlin Mark Ray Ralph 9781847663788 Amazon Com Books

A Uk Outlook Essential Tax Planning For Uk Inheritance Tax And Domicile Britcham Singapore Youtube

Case Study Estate Duty Inheritance Tax Planning The Sovereign Group

Tax Planning Ideas Martin Aitken Co Chartered Accountants

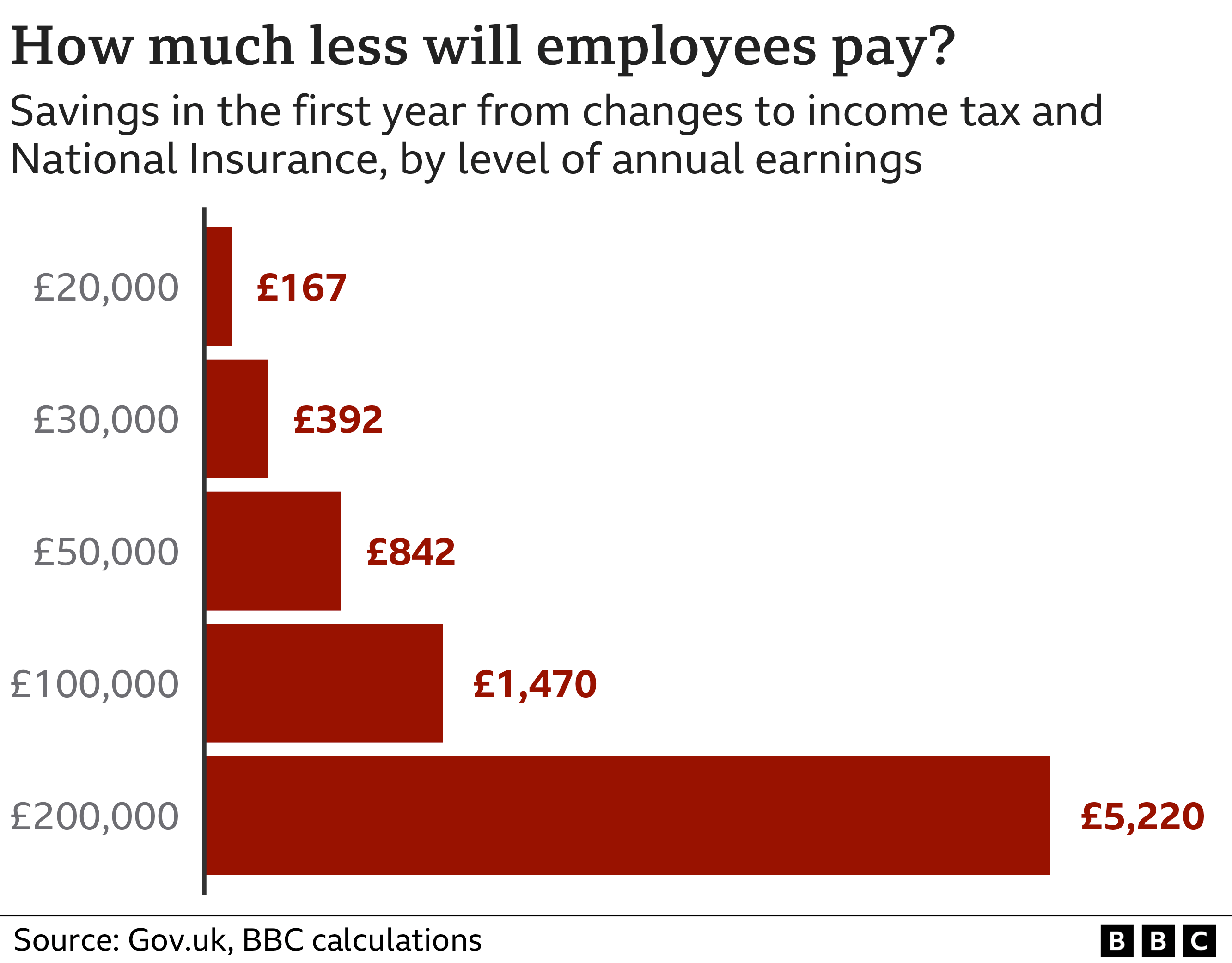

Chancellor Kwasi Kwarteng Hails New Era As He Unveils Tax Cuts Bbc News

Digital Features Us Uk Tax Planning Digital Week